:max_bytes(150000):strip_icc()/couponcabin-home-depot-codes-0466905b48634940975490a932bc71ab.png)

#Does couponcabin cashback work full

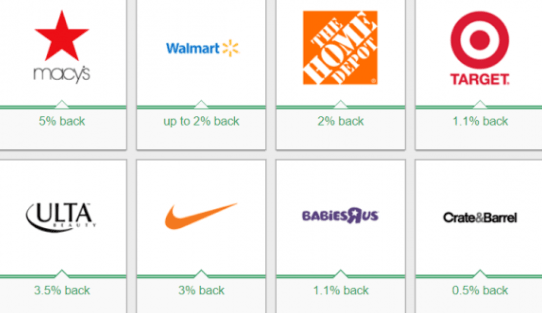

When retailers partner with a cashback site, they do it to attract and retain people like Nelson who know that there’s no need to pay full price. Retailers who opt out of cashback websites altogether (say Nordstrom, or Zappos), may lose buyers. For a customer like Nelson, the site offering the highest cashback will win her business. Say Nike sneakers are available at multiple stores for $90. The cashback websites that emerged in the early days of e-commerce were pitched as a win-win-win for retailers, shoppers, and the middlemen who created them. Some services pay out on a fixed schedule every few months, while others pay as soon as a user earns the minimum. Payments are made after a member hits a certain threshold, which can be anywhere from $5 to $25. A percentage of this commission is then shared with members via a service like PayPal, in the form of cashback. When a member buys something through this link, the cash-back service earns a commission (this is commonly referred to as affiliate marketing). Here’s how it works: a cash-back service links to retailers on its website, indicating the amount of cash members can earn on a purchase (usually somewhere between 1% and 10% of the cost price). The company is in the process of rebranding, but its business model - which has attracted more than 12 million members and more than 2,500 partner retailers - has remained the same.Įbates provided credibility to a market that was initially met with too-good-to-be-true skepticism, and it set the model that many cashback websites follow. In 2014, Ebates was acquired by Rakuten, one of Japan’s largest e-commerce companies.

The first major cashback rewards site, Ebates, launched in 1998. But, say experts, at their worst, they can distort a consumer’s perception of money and turn shopping into a game that favors retailers in the long term. But usually only for a larger purchase.”Īt their best, these cash-back services help consumers save on purchases they would have made anyway.

“If it’s a product that’s consistently priced,” said Nelson, “like a manufacturer’s set a price, then I’ll go and look to see which retailer has the best cashback on which site. She has accounts with three different cashback sites. Rather than letting a good deal sway her purchase, she starts by deciding what to buy, then researches which service has the highest rate of cashback for the store she’s planning to buy from. Nelson is a regular user of cash-back shopping services. For her, it’s easier to compare prices, save time, and avoid distractions by shopping online. Krystal Nelson, an administrative assistant from Gainesville, Florida, says she rarely visits stores anymore.

0 kommentar(er)

0 kommentar(er)